FATCA XML reports

for all IGA Models

All types of financial institutions (FFIs) are supported, including sponsoring entities, territorial financial institutions and intermediaries.

The software prepares properly formatted electronic files, which are ready for filing with every jurisdiction. Avoid the stress of creating XML files that comply with the IRS schema.

The United States collaborated with other governments to develop two model intergovernmental agreements (IGAs) to implement FATCA. We developed different tools, to support the two models.

We continuously update all solutions to ensure compatibility with all schema changes and home country tax authority portals supported.

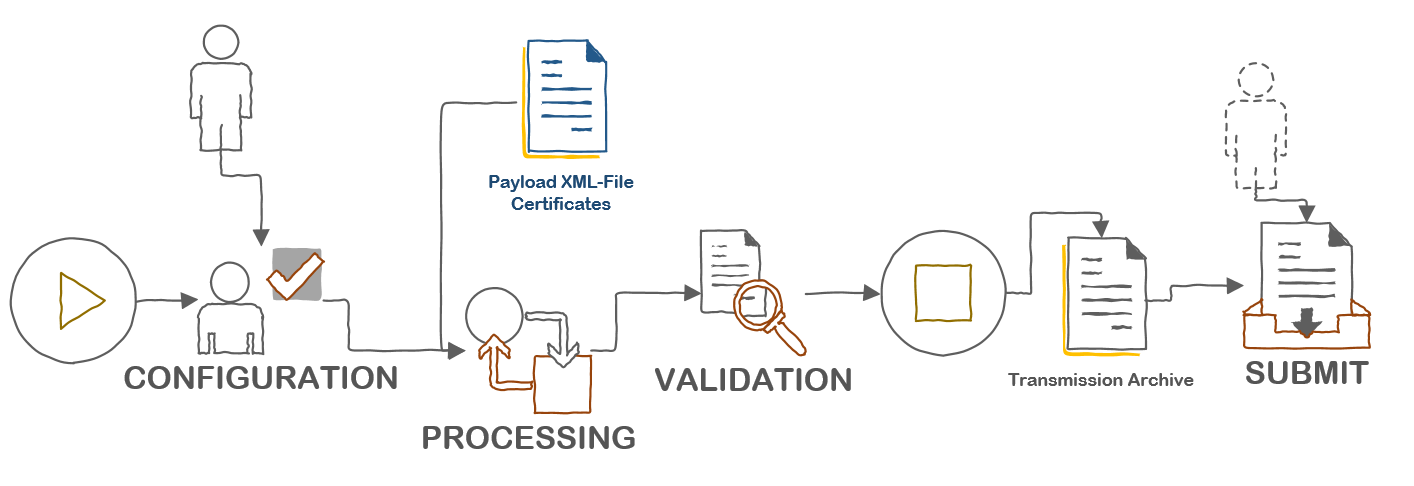

As the FATCA Data Transmission and File Preparation process is quite complex we help to do all with one tool with only a few clicks.

IGA Model 1

FFIs submit their data to their local HCTA. The HCTA will then submit the information.

IGA Model 2

Model 2 Option 1/2: FFIs submit data directly to the IRS and local HCTA (Host Country Tax Authority).

Non-IGA

FFIs with a reporting obligation in a jurisdiction without an IGA will submit the data directly to the IRS.

Features

Simple License

Unlimited GIINs - pay only the number of users working with the product. No other restrictions.

Miss a format?

Do you miss a specific filing format? Be our pilot user! Contact us, we will implement it, with no additional costs!

Library / Source

We are offering a couple of different license types, to serve the need of our clients

One Tool

With only one tool you are able to prepare a FATCA compliant upload package.

No Risk!

Apply for a fully functional test version. Try and make an upload package today.

User Centric

It's made for you. Enter data and generate reports in minutes.

Basic Support

1 year of FREE software upgrades including minor and major feature versions.

60 days e-mail support.

Premium Support

1 year of FREE software upgrades including minor and major feature versions.

One year e-mail support.

Pricing

Pricing is based on the number of users and starts as low as 700.- CHF for up to three users.

Model 1 IGA - FATCA - USMOne

The partner jurisdiction agrees to report to the IRS specified information about the U.S. accounts maintained by all relevant FFIs located in the jurisdiction.

Preparing and filing electronic FATCA XML reports need not be a laborious task. FATCA - USMOne prepares properly formatted electronic files, which are ready for filing with every jurisdiction following the FATCA XML 1.1 standard. Avoid the stress of creating and maintaining XML files that comply with the IRS schema.

Model 2 IGA - FATCA - USMTWO

The partner jurisdiction agrees to direct and enable all relevant FFIs located in the jurisdiction to report specified information about their U.S. accounts directly to the IRS

The International Data Exchange Service (IDES) is the electronic delivery point where Financial Institutions (FI) and Host Country Tax Authorities (HCTA) can transmit and exchange FATCA data with the United States.

As the IDES Data Transmission and File Preparation process is quite complex IDEaSy will help you to do all with one tool with only a few clicks.

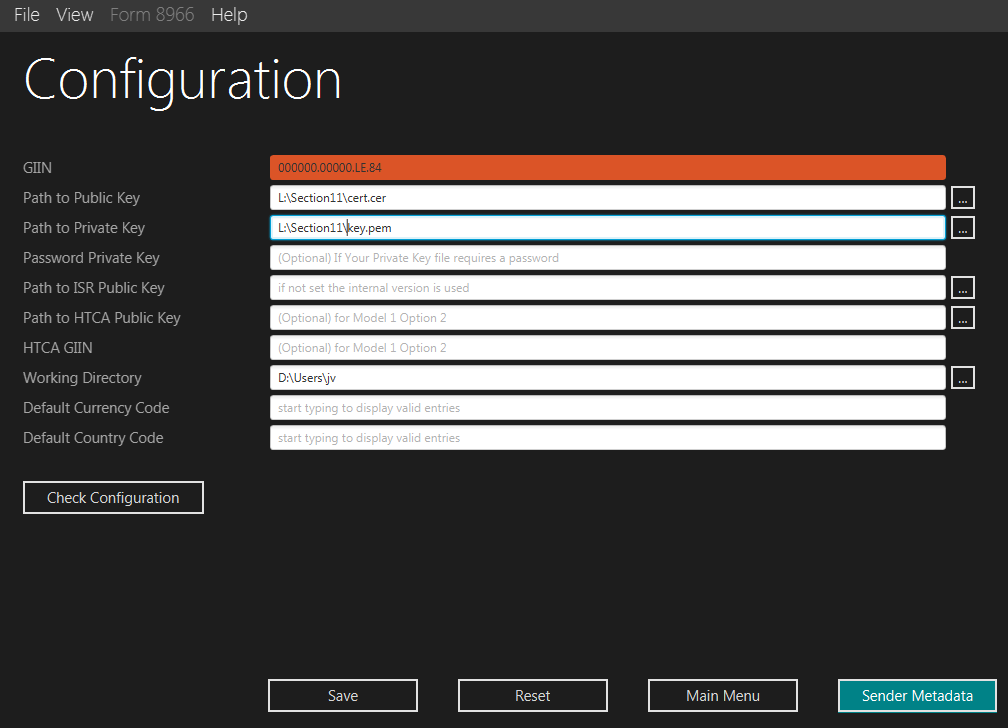

Just enter all required information into the configuration screen and start the process. The output is a validated, encrypted, signed, ready-to-upload zip-file.

As an optional step, the tool can generate the required sender meta data XML-file.

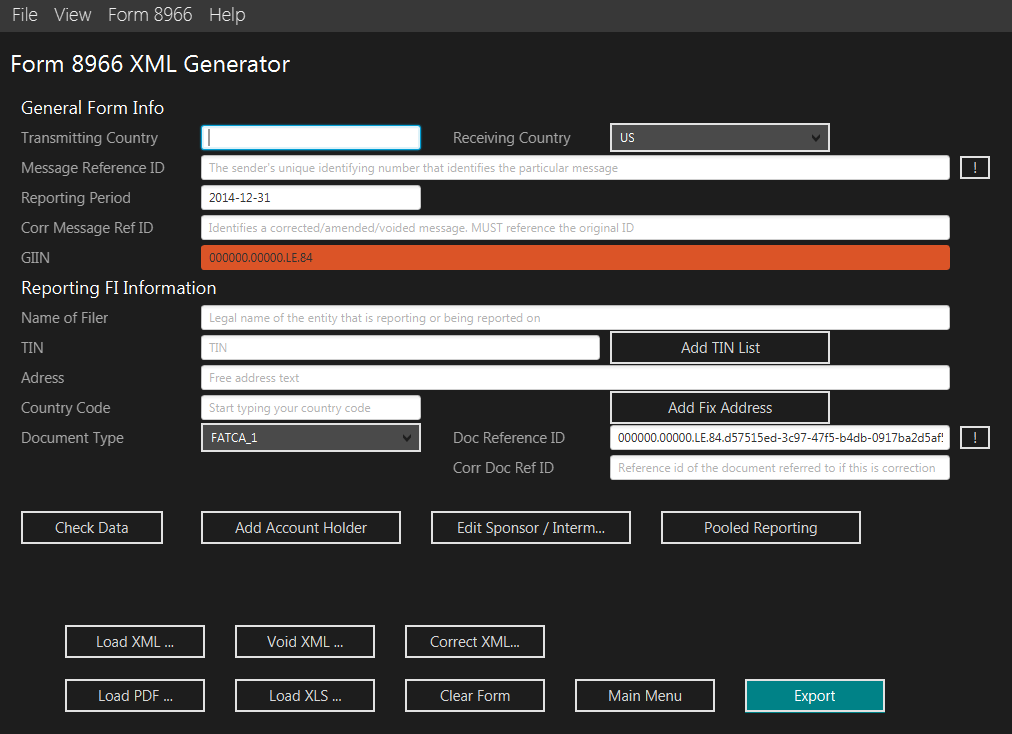

Furthermore generating the FORM 8966 FATCA XML 1.1 payload (FATCA - USMOne functionality) is also supported!

Tax Authorities - FATCA - USMHTCA

Our special version for tax authorities with extended configuration and functionality to act as the intermediary between the local FIs and the IRs.

Next look at some Screenshots

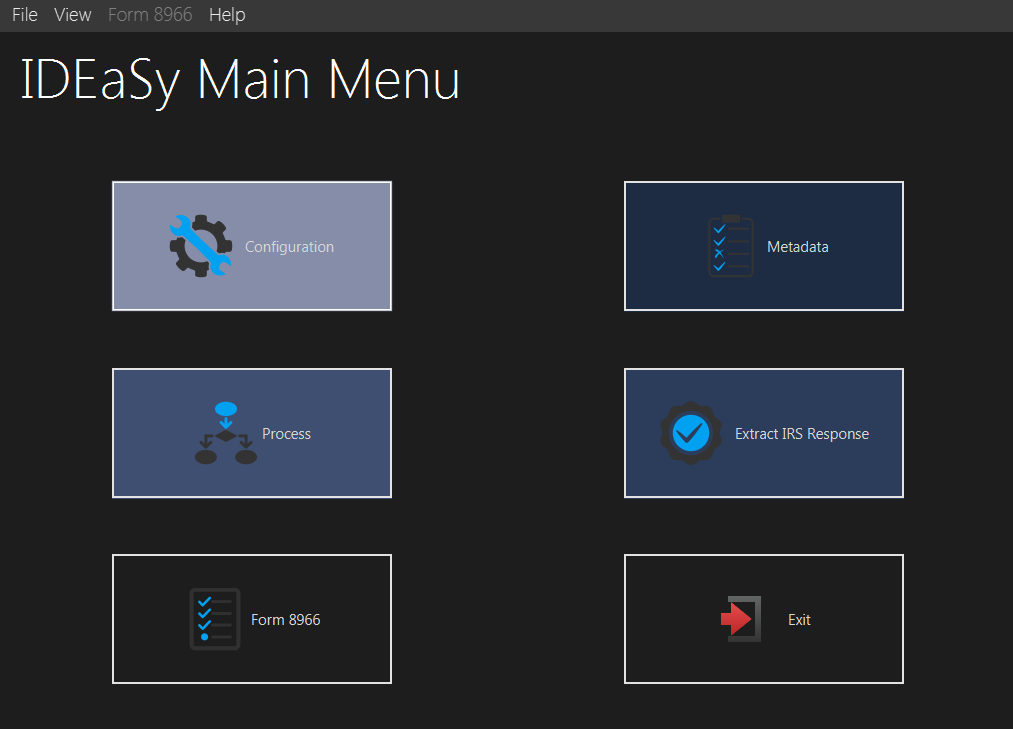

Main Menu

The IDEaSy GUI main window contains a navigation area with the central functions of the program: To generate the transmission archive the idea is, to follow a simple wizard like approach.

Easy Configuration

The configuration screen allows the user to enter all required information to generate a valid transmission archive.

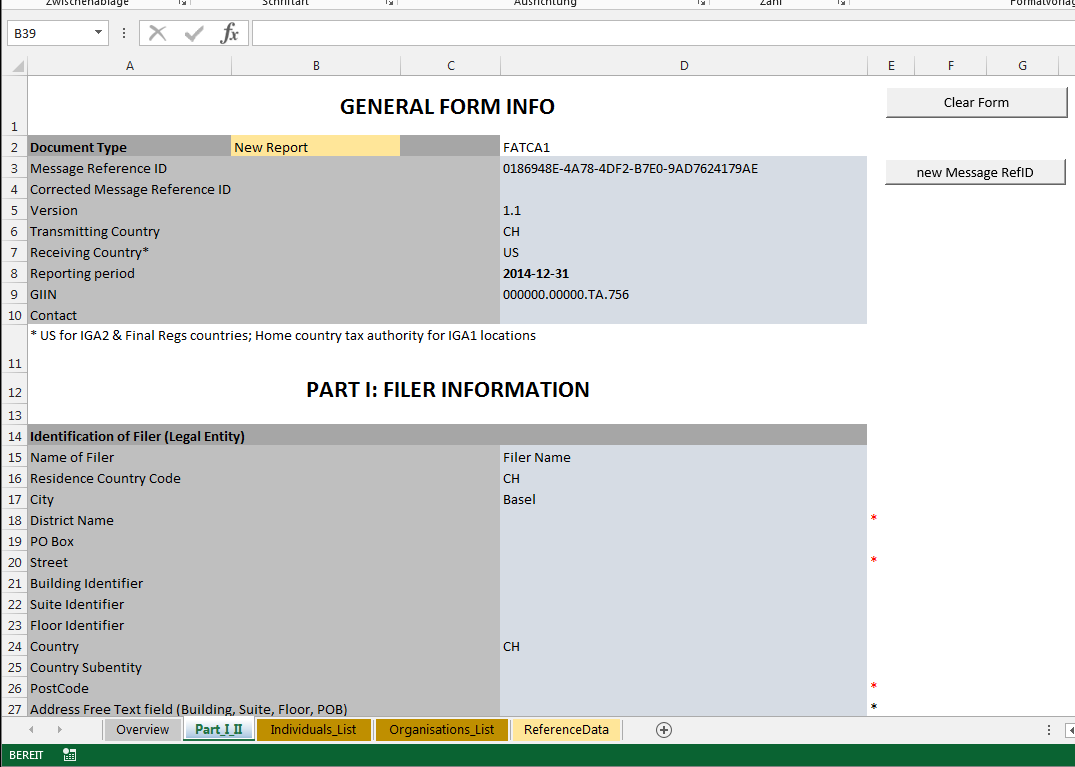

Form 8966 reporting

Generate NIL, Pool or Account Holder reports. Import data from XML, PDF or XLS. Void/Amand/Correct previously filed reports.

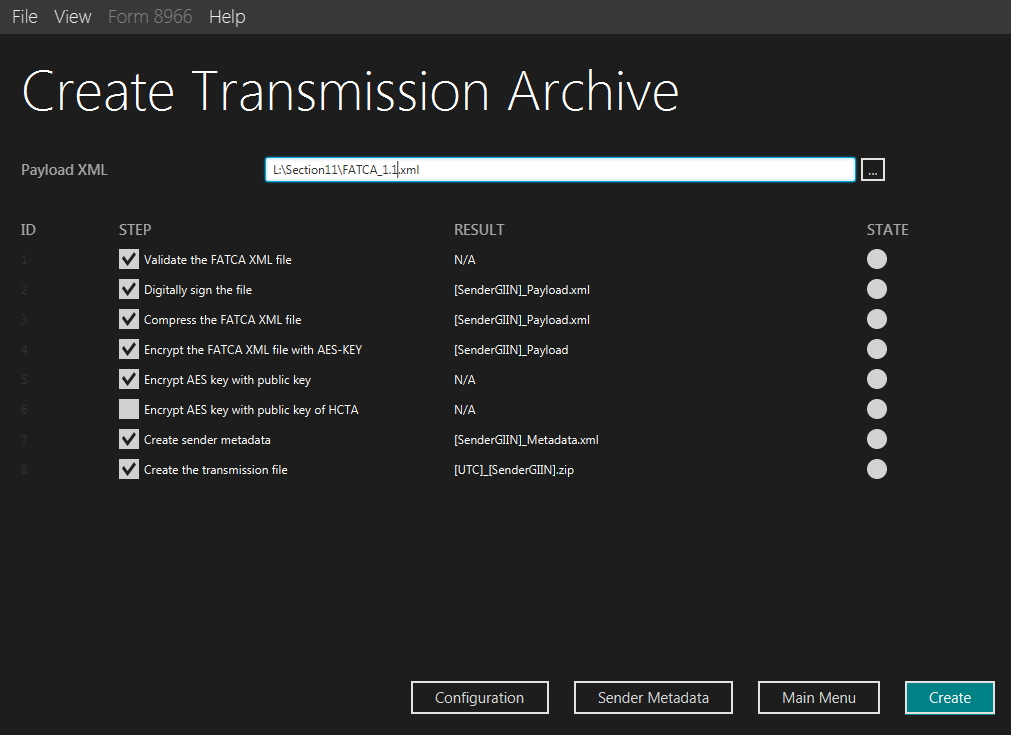

Create Transmission Archive

Digitally sign and encrypt files for IDES/HTCA and generate a valid transmission archive following the defined IRS naming conventions.

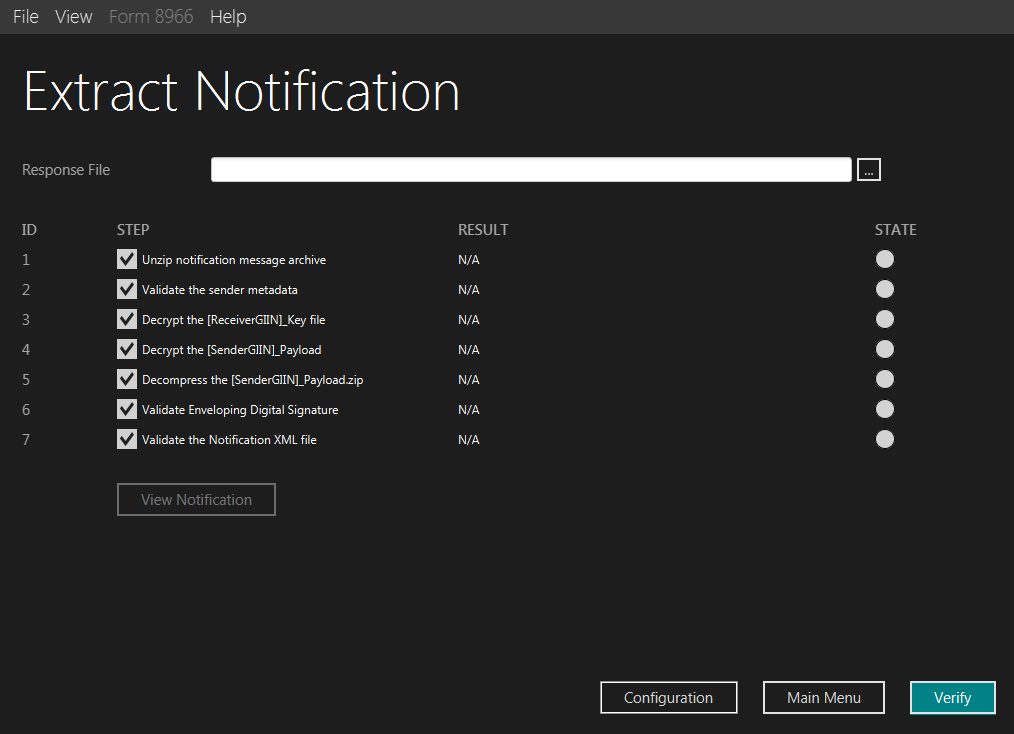

Extract IRS response

Decrypt messages received from IDES gateway.

Excel Template

Our software comes with a standard Excel template to collect your data and transfer it into the FATCA XML 1.1 XML schema.